Angelsmith recently conducted a survey of more than 1,200 affluent, self-described wine and food aficionados. Our goal was to better understand how American consumers choose new winery tasting experiences and what most contributes to their decisions. Analyzing the results, it became clear consumers take a complex journey and apply various levels of importance to channels at different phases along their path to purchase.

The best example of this phenomenon is consumer reviews. Respondents overwhelmingly reported that poor consumer reviews can veto a winery in the early stages of consideration, but once they’ve determined their top choices those reviews hold less influence.

Other Key Takeaways

- Location is decided first, then individual wineries are considered.

- Price is less of a gating factor than we would have expected.

- Overwhelmingly, consumers want unstructured, public experiences.

- There is no holy grail of visitor marketing. Numerous influences contribute to the decision.

- Wineries control some of the most influential steps in the consumer decision making process.

The Winery Experiences Decision Ecosystem

We call our analysis The Winery Experiences Decision Ecosystem to simplify understanding of how the different marketing channels intersect and impact consumers’ decisions. The ecosystem concept originated in 2010 when we uncovered How Consumers Choose Restaurants through our survey analysis. Those statistics have been used in academia, by institutional investors, and by restaurants around the world. We think this framework can be just as helpful for the wine industry. Even though we still talk about the ‘sales funnel’ it has been more helpful for us to visualize the customer journey as an ecosystem.

Ever-Changing Consumer Behavior

Consumer survey results continue to reveal that buying behavior frequently changes. The results can surprise marketers; but they also provide confirmation of some expectations. We fielded our first restaurant survey in 2009, three years before we understood the complex consumer journey of what we coined The Dining Decision Ecosystem. Over those three years, rapid technological growth changed the way consumers chose restaurants. We anticipate similar dramatic changes to consumer buying behavior in the wine industry.

About the Audience Panel

Angelsmith distributed our survey to a geographically diverse audience who love wine and are considered affluent. All respondents had visited a winery in the last 12 months.

Frequency of Visits

44.79% of survey respondents reported visiting a winery between 2-6 times per year. The next largest group (30.59%) reported visiting once per year. Overall, 9.28% reported visiting monthly, while 13.51% visited every 2-5 years.

Number of Wineries per visit

More than 6 out of 10 (61.86%) wine consumers visit between 2 – 4 wineries on each trip. Still a significant number, 19.48% report visiting only one winery per trip, and 16.32% visit more than 5 on each trip. Those who report 2-5 annual wine experience trips are also slightly more likely to visit more wineries on each visit.

Survey Statistics reveal six phases in the consumer’s path to purchase

Passive Awareness

- A consumer hears about a brand, product, or service when they don’t necessarily have a need.

Active Awareness

- A consumer with a specific need takes active steps to become aware of a product or service.

Consideration

- A consumer weighs the pros and cons of a specific set of brands, products, or services.

Validation

- A consumer researches the brands, products, or services to verify their choices.

Purchase

- A consumer decides to purchase a specific product, brand, or service.

Advocacy

- Following an excellent experience, a consumer shares it with others.

Top of the funnel: Initial Awareness

While initial awareness for most verticals comes from word of mouth, we specifically omitted that option as a selection from this survey. We wanted to know what other marketing channels generate awareness of new wineries.

A detailed look at passive and active awareness

Passive Awareness is when information is transmitted to a consumer during their daily activities when they aren’t actively seeking to fill an immediate need. An example of this is when a consumer catches information about a winery experience online reading an organic or paid post in their social media newsfeed. This type of passive information gets filed away in memory, recalled later when a person has an active want or need.

During Active Awareness, the consumer takes steps to acquire recommendations. Active Awareness would be when a consumer types in ‘Wine Tasting Napa Valley’ or other generic term into a search engine such as Google. They might also ask for recommendations on Facebook in a social post such as, “What are the most luxurious wine and food pairing experiences in Paso Robles?”

The differences between these two levels of awareness is relevant to these survey results because it can help wine marketers authentically Intercept & Influence™ the potential guests that match their organization’s business goals.

Organizing the Channels

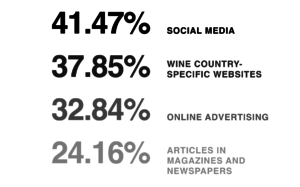

We organized survey results by how wine visitors ranked them, and how we believe they’re being utilized in the both the passive and active awareness phase. Of the top four channels, we classify social media, online advertising, and newspaper and/or magazine articles as passive awareness channel. For those in our panel who report visiting wineries 2-6 times per year, a winery visit may always be imminent. Whether they’re catching up with the world on social media or reading a chance article in a magazine, information passively crossing their path contributes to their overall awareness.

In contrast, Active Awareness occurs when consumers turn to wine country-focused websites, such as napavalley.com. The consumer takes active steps to visit the site to find a winery tasting experience which suits them.

Consumers rank where they’re most likely to first learn about a new winery experience

Not only was Social Media the most popular choice, but the majority (56.61%) of respondents reported a likely to very likely chance they would click on a post about an unfamiliar wine tasting experience in their social media newsfeed. Online Advertising was also impactful raising awareness and can contribute to a specific winery being considered. Although newspaper and magazine articles were ranked fourth, based on information outside our survey we believe articles carry more influence. We believe it’s the infrequency in which consumers come across articles that may contribute to their ranking in the survey.

Magazine-style websites focusing on wine tourism will naturally outrank individual wineries and can be especially helpful in raising awareness for potential visitors. Websites with naturally high ranking SEO, such as sonoma.com, are a great place for consumers to find a list of winery experiences to choose.

From Awareness to Consideration

Consumers move from awareness of a winery to consideration by narrowing their consideration set down to a subset of brands they will evaluate before making a final purchase decision. The majority (69.87%) of our respondents reported considering 5 or fewer wineries, with the bulk (38.45%) of those considering between 3 to 5.

Research is important, even essential, to most consumers. Only 6% of respondents reported doing nothing when asked how often they take a variety of steps when they begin their search for a new wine tasting experience. In contrast, more than 8 out of 10 (86.62%) frequently or sometimes use search to find a new winery tasting experience.

Of those who take active steps to find a winery experience, the majority (67.47%) spend less than an hour on research before visiting a winery. Approximately 12% of consumers report doing their research on the drive up. That short timeframe means three things:

You don’t have much time to influence their decision

Your offer needs to be more compelling than your competitor’s! So, know your competitors.

Do anything to avoid the veto vote.

From Consideration to Validation

As consumers prepare to decide which wineries they’re going to visit, they look for validators. Our survey results indicate those validators include official winery websites, social media accounts of wineries, and consumer review sites such as Yelp and TripAdvisor.

Winery Websites Greatly Influence Decisions

Nearly 8 out of 10 (78.35%) survey respondents reported frequently or sometimes reviewing official winery websites. To us, this is exciting news. It means that every winery has a fair chance of winning consumers over with a well-thought-out website. If you look at your Google Analytics under Acquisition > Channels you’ll see the principle ways consumers access winery websites.

Direct

They have the winery in their consideration set, type it in directly, and navigate to the website. Direct is also a catch all bucket for Google Analytics when attributions are lost.

Consumer Review Sites

Survey respondents overwhelmingly (67.78%) reported checking consumer review sites when they begin searching for a new winery tasting experience. Consumer reviews sites include websites such as Yelp!, TripAdvisor, Google My Business and others.

Social Media

Another validator, more than 6 out of 10 (66.20%) look at social media accounts of wineries they are considering when they are planning their trip.

From Validation to Purchase

Consumers do the research, validate their choices, and now they’re ready to visit. There are several items the winey controls in terms of their website. Make sure it delivers the information the consumer needs, such as a phone number, address, hours of operation, and reservation policies. When providing all this information think about those consumers who are deciding on the drive up, and make your site super accessible for fat fingers on mobile. Some things are out of your control. For example, the top consideration for many consumers is location. You can still anticipate and provide detailed information and triggers like, “only 5 minutes from downtown Healdsburg,” to attract those looking in your area.

What’s Most Important?

#1 LOCATION

According to our survey respondents, they ranked location as both the first (37.7%) and the second (31.62%) most important consideration when looking for a new winery tasting experience. This data indicates they already know which region, AVA, or general area they’re going to visit, and are looking for wineries in those pre-determined spots. This may indicate that organizations such as area-specific vintners groups can have a meaningful impact on consumers decisions about which area to visit.

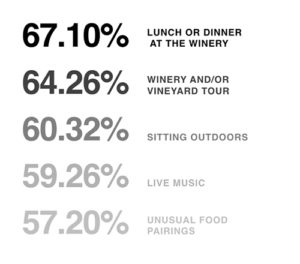

#2 TYPE OF EXPERIENCE

Type of experience was the second most important consideration by most of the survey respondents. 34% of survey respondents cited limited or lack of experiences that interest them as a disqualifier when researching new winery tasting experiences.

#3 WINE VARIETALS

Surprisingly, type of wine varietals was ranked after experiences.

#4 PRICE

Although price was cited near the bottom of our survey, we are cautious about dismissing it as inconsequential.

Trailing the pack was ease of making a reservation. As you’ll see later, this isn’t necessarily surprising given that consumers overwhelmingly don’t want to make a reservation.

Avoiding the Veto

The number one disqualifier for a winery is poor consumer reviews. More than half (60.81%) of respondents ranked poor reviews as the number one reason to take a winery off their list. Almost as detrimental as poor reviews are no information at all. 37.45% of respondents ranked ‘lack of information’ as a reason to exclude the winery. A lack of experiences that interest the consumer was also listed by 34.57% of respondents as a reason to remove a winery from their consideration set. Although price doesn’t play much of a role, its absence may contribute to the ‘lack of information’ and be more of a contributing factor than is represented.

Preferred Types of Experiences

Personal Experience is the biggest influence. Overwhelmingly, consumers reported that their decision came down to their personal search and experience. Second most important was the winery website, followed by photos of wineries online. From our experience, we know that images of the winery from the front door are hugely impactful when advertising. Consumers want to see where they’re going and if the visual matches their expectations.

Structured vs. Unstructured and Public vs. Private

The clear majority of consumers (75%) prefer public experiences to private appointments, flexible times (79.35%) rather than schedules, and self-directed, unstructured experiences (71.74%) such as wine flights at a bar rather than a wine educator-directed, structured experiences.

In many ways, this makes sense. For most people, wine tasting is a relaxing, low key experience. They’re escaping from everyday stresses and don’t want to be pressured into a timeframe or schedule. This may offer an opportunity for wineries and regions where the reservations policies are less stringent.

It should be noted there’s a subset of consumers who prefer structured experiences. You should weigh these results against your own experience. You know your consumers best. We have clients, for example, who routinely sell out blending seminars. We’re still analyzing this group and will present our findings soon.

Final Thoughts

When choosing a wine tasting experience, the consumer’s decision making process is complex. It involves several steps and multiple inputs. You can still have a great experience even when the wine isn’t to the consumer’s taste. If your consumer reviews reflect poor customer service or other issues, correct those ASAP. Reputation management, SEO, & social media marketing are critical pieces for winery tasting rooms.

Survey Methodology

The Survey was conducted by Angelsmith, a Richmond, Calif-based digital advertising agency, in October and tallied results from the 1269 respondents. Survey analysts include Carin Galletta Oliver and Eric Oliver. The survey was delivered to select individuals in Angelsmith email databases and through social media channels. The digital survey was hosted on SurveyMonkey.com and designed to provide a better understanding of how consumers decide on wine tasting experiences. An Amazon gift certificate was given to a randomly selected survey participant and the agency donated to the North Bay Fire Relief Fund to incentivize people to take the survey.